What is software development? Software development refers to a set of computer science activities dedicated to the process of creating, designing, deploying and supporting software. Software itself is the set of instructions or programs that tell a computer what to do.

Mobile Application Development Overview

1. Planning and Research

2. Design

3. Development

4. Testing

5. Deployment

6. Post-Launch Support

Affiliate marketing is a performance-based marketing strategy where an individual or company (the "affiliate") earns a commission by promoting products or services of another business (the "merchant") and driving sales or leads to that business. The affiliate earns a percentage of the revenue generated from their marketing efforts.

We have Provided Affiliate Campiang As Follows

1. Loans

2. E Commerce

3. Insurance

4. Demat Account Opening

5. Bank Account Opening

6. Credit Cards

7. Flight/Bus/Train/Hotel Booking

Here's how affiliate marketing typically works:

1. Affiliate Joins an Affiliate Program

- An affiliate marketer signs up for an affiliate program offered by a business (merchant) or an affiliate network. These programs provide affiliates with unique tracking links (affiliate links) to promote the business's products.

2. Affiliate Promotes Products

- The affiliate promotes the merchant's products through various channels, such as blogs, websites, social media, YouTube, email marketing, or paid advertising. They share their affiliate links, which track their performance.

3. Customer Makes a Purchase or Action

- When a consumer clicks on the affiliate's unique link, they are directed to the merchant's website. If the consumer makes a purchase or takes a specific action (like signing up for a service), the affiliate is credited for the sale.

4. Affiliate Earns a Commission

- The affiliate earns a commission based on the sale or lead generated through their affiliate link. The commission structure varies and can be:

- Cost per Sale (CPS): The affiliate earns a percentage of the sale price.

- Cost per Lead (CPL): The affiliate earns a commission when a lead is generated (such as filling out a form or signing up).

- Cost per Click (CPC): The affiliate earns money based on how many clicks their link receives, even if the click doesn't result in a sale.

5. Merchant Pays the Affiliate

- The affiliate is paid according to the payment terms set by the affiliate program, which could be monthly, weekly, or after a certain threshold is reached.

As the MSMEs are amongst the strongest drivers of economic development, innovation and employment, it becomes imperative to strengthen their ecosystem. The Government of India envisioned the Zero Defect Zero Effect (ZED) initiative to enhance MSME competitiveness, make them sustainable and transform them as National and International Champions.

MSME Sustainable (ZED) Certification is an extensive drive to create awareness amongst MSMEs about Zero Defect Zero Effect (ZED) practices and motivate & incentivise them for ZED Certification while also encouraging them to become MSME Champions. Through the journey of ZED Certification, MSMEs can reduce wastage substantially, increase productivity, enhance environmental consciousness, save energy, optimally use natural resources, expand their markets, etc. MSMEs will also be motivated to adopt best practices in work culture, standardisation of products, processes, systems etc. in order to enhance their global competitiveness and sustainability. The ZED Certification aims at enhancing the competitiveness of an MSME through assessment, handholding, managerial and technological intervention etc., hence it is not just a Certification.

This Scheme is proposed to be implemented in 2 Phases:

Phase 1: For Manufacturing MSMEs with UDYAM Registration. This phase will focus largely on maximizing inclusion of manufacturing MSMEs and taking them through the journey of ZED.

Phase 2: Inclusion of Service Sector MSMEs. This phase will also strive to integrate those MSMEs (manufacturing and Service Sectors) who are registered under a State Government protocol/system but not on UDYAM. From this phase onwards, additional information regarding MSME operations/performance may be collected so as to create a National MSME Competitiveness Index.

In phase 2, it is also envisaged to provide funding to the ZED Certified MSMEs to obtain international certifications, as necessary for international market and further, making provisions to align ZED Certification with the international certifications for its global acceptance.

MSME Sustainable (ZED) Certification can be attained in THREE Levels after registering and taking the ZED Pledge:

ZED Pledge

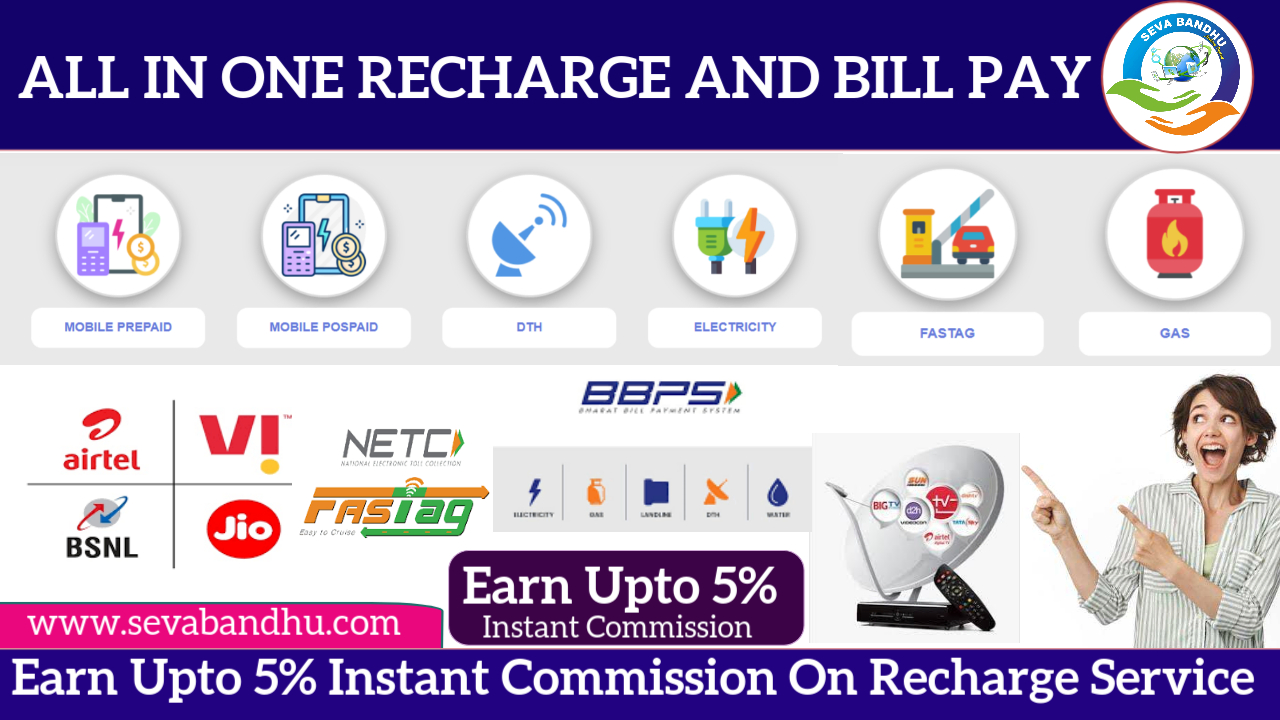

In India, utility bill payments are an essential part of managing household finances, and there are several options available to pay bills such as electricity, water, gas, broadband, and more. Here are the most common utility bill payment services in India:

Many utility service providers have their own online payment systems where users can directly pay bills. Some of these include:

AEPS (Aadhaar Enabled Payment System) is a banking service in India that allows users to carry out financial transactions using their Aadhaar number and biometric authentication. AEPS leverages the Aadhaar database for identification and enables a wide range of banking services through a simple and secure method, especially for those without easy access to traditional banking infrastructure.

Key Features of AEPS

1. Aadhaar Number as Identification: AEPS uses the Aadhaar number (a unique 12-digit identity number issued by the Indian government) to authenticate users, allowing them to access banking services without needing physical debit or credit cards.

2. Biometric Authentication: AEPS utilizes biometric data (fingerprints or iris scan) for secure transactions. The user’s fingerprint or iris is used for authentication instead of PIN or passwords.

3. Types of Transactions:

- Cash Withdrawal: Users can withdraw cash from their bank account at any AEPS-enabled bank kiosk or point of sale (POS) terminal.

- Balance Inquiry: AEPS allows checking the balance of a linked Aadhaar-enabled bank account.

- Fund Transfer: Users can transfer funds to any other Aadhaar-linked bank account.

- Deposit: AEPS also allows cash deposit to a linked account.

4. Interoperability: AEPS allows users to access their accounts from any AEPS-enabled bank, regardless of the bank in which they hold an account. This makes it highly convenient, especially for rural and remote areas.

5. Ease of Access: AEPS helps in banking without needing physical documents like cards or cheques. This is particularly useful for people who may not have smartphones, access to ATMs, or traditional bank branches nearby.

How AEPS Works:

1. Step 1: Authentication

The user provides their Aadhaar number (12-digit) to the bank, either via a banking agent or through a point of sale (POS) terminal. The biometric (fingerprint or iris) is captured and verified.

2.Step 2: Transaction Type

Depending on the transaction type (withdrawal, balance check, fund transfer, etc.), the system processes the request. The Aadhaar number is linked with the user's bank account, allowing the system to retrieve and verify account details.

3. Step 3: Authorization

After biometric authentication, the bank verifies the request using the Aadhaar database and proceeds with the transaction.

4. Step 4: Transaction Completion

Once verified, the transaction is processed and completed. The user will receive a receipt or confirmation of the transaction.

Advantages of AEPS:

- Accessibility: AEPS bridges the gap between urban and rural India by allowing users in remote areas to access banking services without needing to travel long distances.

- Security: The use of biometric authentication ensures secure transactions, minimizing fraud risks associated with traditional methods like PINs and passwords.

- Convenience: It eliminates the need for physical cards, cheques, or passbooks, simplifying the process of conducting financial transactions.

- Interoperability: AEPS allows transactions between different banks, even if the sender and recipient have accounts in different institutions.

- Low-Cost Solution: AEPS is an inexpensive way to provide banking services to people in rural areas, using low-cost point of sale (POS) terminals and kiosks.

How to Use AEP

1. Visit an AEPS-enabled center: Go to any authorized AEPS center, such as a banking correspondent, agent, or kiosk.

2. Provide your Aadhaar number: Share your Aadhaar number with the agent.

3. Verify using Biometric Authentication: The agent will scan your fingerprint or iris to authenticate the transaction.

4. Complete the Transaction: Depending on the service, you can withdraw cash, check your balance, or transfer funds.

5. Confirmation: You’ll receive a receipt or transaction confirmation for your records.

Domestic Money Transfer (DMT) refers to the process of transferring funds from one person or entity to another within the same country. These transfers can occur through various financial institutions, payment systems, and channels, each with its own features, fees, and speed of execution.

Here's a comprehensive look at domestic money transfers:

The Permanent Account Number (PAN) is a unique alphanumeric identifier issued by the Indian Income Tax Department. It's primarily used for tracking financial transactions and preventing tax evasion. Here are some key details about PAN:

AAAAA9999A.

A Computer Course Certificate is issued to individuals who have completed training or education in specific computer-related skills. These certificates are widely recognized in educational and professional settings. Below are some details and examples related to computer course certificates:

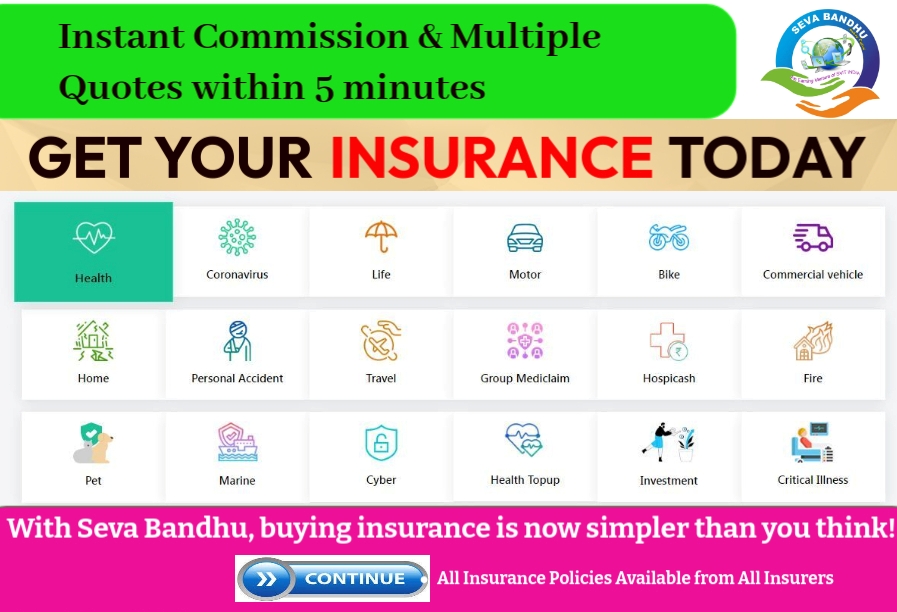

We have Provide Following Insurance Products Through Our Seva Bandhu Portal

1. Bike Insurance

2. Car Insurance

3. Commercial Vehicle Insurance

4. Health Insurance

5. Hospicash

1. On-Time Commission Disbursement

2. Weekly/Monthly Sales Contest (Cash, Vouchers & Holiday Trips)

3. All Insurance Policies Available from All Insurers

4. Instant Multiple Quotes within 5 minutes

5. Automated Custom Built Agent Management System

6. 24x7 Support & Assistance

Seva Bandhu Associate Partner with GIBL Its India's fastest-growing, innovating, dynamic & award-winning insurtech platform trusted by 25 Lakh+ Registered Customers across the country for over 8 years. We are licensed by the Insurance Regulatory and Development Authority (IRDAI) and partnered with 56 Insurance companies which include Health Insurance, Life Insurance, Car Insurance, Travel Insurance, Two-Wheeler Insurance Sectors and many more.

We have developed an easy Web & Mobile App based Marketplace that makes insurance policy discovery, unbiased comparison & procurement of different policies effortless. We provide our customers with personalized value-added services like - 1 Click Renewal, Policy Vault, Claim Tracking, Interactive Q & A, Renewal Reminder etc.

You Can Download your Complete PDF CIBIL Report Just @ 149/- Only

ANY Body Can Start Real Estate Business With ZERO Investment and Earn AWESOME Earnings on Each Property Sale..

Buy or Sell Any Property Through Seva Bandhu SBE will get Rs.1% Commission on Total Property Sale Value

Real Estate Services

GST Registration is a process in which businesses, individuals and other entities need to register themselves with the Goods and Services Tax Network (GSTN) in order to become eligible to avail the benefits of GST. It is mandatory for businesses having an annual turnover of more than Rs. 20/40 lakhs to register for GST(20 lakhs in case of service and 40 lakhs in case of goods) and those with an annual turnover of less than Rs. 20/40 lakhs can opt for voluntary registration. GST Registration involves furnishing of basic details such as name, address, PAN, TAN, etc. and documents such as address proof, ID proof, etc. Once registered, the taxpayer will be assigned a unique GSTIN (GST Identification Number) which is required for filing GST returns. Therefore, GST Registration is an important step for businesses to avail the benefits of GST.

The list of required documents for GST Registration for various businesses as follows:

- PAN Card

- Address proof of proprietor

-PAN Card of LLP

-LLP (Limited Liability Partnership) Agreement

-All Partners’ Names

-All Partners’ address proof

- Certificate of Incorporation

- PAN Card of Company

- AOA Articles of Association,

- MOA Memorandum of Association,

- Resolution signed by all board members

- Identity of all directors

- Address proof of directors

- Digital Signature all directors

GST Return is a process used to declare the Goods and Services Tax (GST) liability of a taxpayer. It is an online form that contains the details of all the supplies made, input tax credit availed, and the GST due for a particular period. It must be filed regularly, as per the GST law, to ensure that the taxpayer complies with the GST regulations. Moreover, it ensures that the GST collected is properly deposited with the government in a timely manner. Consequently, GST Return is an important document for both businesses and taxpayers, as it helps them track their GST liabilities accurately and efficiently.

Under GST, a registered dealer has to file GST returns that broadly include:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

Individuals and businesses who are registered under GST must file GST returns. All registered GST taxpayers must file their returns on a quarterly/monthly basis. The due date for filing GST returns varies depending on the type of taxpayer. Therefore, it is important for all GST registered taxpayers to file their returns on time in order to avoid any penalties or fines.

Filing GST returns can be a easy task for businesses, but the advantages it brings are manifold. The primary benefit is that it simplifies the entire process of collecting, remitting, and filing taxes. Additionally, it allows businesses to accurately track their income and expenditure, and consequently, avail tax credits and deductions. Moreover, it also provides a convenient platform for businesses to track transactions, and audit their accounts. Furthermore, it helps to reduce the administrative costs associated with tax filing, while also providing greater transparency to the government regarding the tax system. Ultimately, filing GST returns ensures that businesses remain compliant with the law and are able to benefit from the advantages it offers.

- Removing cascading tax effect

- Higher threshold for registration

- Composition scheme for all small businesses

- Simpler online procedure under GST Return

- Lesser number of compliances

- Regulating the unorganized sector

- Defined treatment of E-Commerce

- Increased efficiency of logistics.

Income tax is a direct tax that a government levies on the income of its citizens. The Income Tax Act, 1961, mandates that the central government collect this tax. The government can change the income slabs and tax rates every year in its Union Budget.

Income does not only mean money earned in the form of salary. It also includes income from house property, profits from business, gains from profession (such as bonus), capital gains income, and 'income from other sources'. The government also often provides certain leeway such that various deductions are made from an individual's income before the tax to be levied is calculated.

Income Tax Returns (ITR) forms are the basis of calculating a person's income tax. It is a statement showing the status of a person, all their sources of revenue, deductions and, lastly, the tax payable or tax refund, if any. With Web Online CA , taxpayers can quickly, easily and securely file their returns, have access to their tax return information also know how to file income tax return, and make sure their taxes are accurate, up-to-date and in compliance with the laws. With ITR Online, you can make sure you're maximizing your deductions and getting the most out of your tax return.

The due date for income tax return filing is an important date for taxpayers to keep in mind. As the deadline for filing taxes for the year approaches, taxpayers should make sure to take note of the due date for income tax e-filing in order to ensure that their taxes are filed on time. The due date for filling income tax return is July 31 every financial year. With the proper planning and preparation, it is possible to successfully file taxes before the deadline.

Do you want to file your income tax returns but don’t know what documents you need? Filing income tax returns can be a daunting task, but it doesn't have to be. Knowing what documents you need to file your income tax returns can help make the process much smoother. SEVA BANDHU will discuss the documents required for income tax eFiling and how to make sure you have everything you need.

MSME or SSI Registration is the official process of registering a business as a Micro, Small, or Medium Enterprise with the government. This registration helps businesses access various benefits such as subsidised loans, credit support, tax exemptions, and government schemes. It is a simple, online process where business owners submit key details and documents to obtain recognition under the Udyam Registration system.

Registering under MSME not only makes it easier to access financial aid but also helps in business growth, legal protection, and participation in public tenders.

Any business that meets the revised investment and turnover criteria set by the Ministry of MSME can apply for MSME registration under Udyam Aadhar. Whether you are a startup, small-scale unit, or a service-based enterprise, registration can help you access a wide range of government benefits.

Here's a list of entities eligible for MSME/Udyam registration:

- Individual entrepreneurs and startup founders.

- Sole proprietors running small or local businesses.

- Private Limited and Public Limited Companies.

- Limited Liability Partnerships (LLPs).

- Partnership firms.

- Trusts engaged in manufacturing or service-related activities.

- Co-operative societies operating in trade or services.

- Self-Help Groups (SHGs) involved in economic activities.

MSME registration is an important step for small businesses, as it provides a range of benefits and can open up new opportunities. It grants businesses legal recognition and access to government subsidies, loan schemes, and other financial assistance. Additionally, it ensures compliance with laws and regulations, helps attract new customers and vendors, and creates a professional image. Furthermore, MSME registration also offers tax benefits, including exemptions on certain taxes, and simplifies the payment process with banks and other financial institutions. Therefore, registering an MSME is a crucial step for small businesses, allowing them to take advantage of a range of benefits and foster their growth.

Registering your business under Udyam Aadhaar brings several advantages for MSMEs:

- Access to collateral-free business loans.

- Enjoy reduced interest rates under eligible schemes.

- Easier process to get licenses and registrations.

- 50% fee concession on trademark and patent filings.

- No security deposit needed for government tenders.

- Get discounts on utility bills like electricity and water.

- Protection under the law for delayed payments from clients.

Udyam Aadhaar simplifies business operations and unlocks financial support for small enterprises.

MSME registration is an important step for small businesses, as it provides a range of benefits and can open up new opportunities. It grants businesses legal recognition and access to government subsidies, loan schemes, and other financial assistance. Additionally, it ensures compliance with laws and regulations, helps attract new customers and vendors, and creates a professional image. Furthermore, MSME registration also offers tax benefits, including exemptions on certain taxes, and simplifies the payment process with banks and other financial institutions. Therefore, registering an MSME is a crucial step for small businesses, allowing them to take advantage of a range of benefits and foster their growth.

The Udyam Registration Process is an easy and straightforward process that enables entrepreneurs to register their businesses. It involves the completion of a simple online form and the submission of essential documents, such as the business plan, GST registration, and the documents related to the owners and directors. Furthermore, the process can be completed quickly and efficiently, thereby allowing entrepreneurs to start their businesses without any delay. Additionally, entrepreneurs can also easily track their registrations and maintain records of their businesses through the Udyam portal. Thus, the Udyam Registration Process is a convenient and efficient way for entrepreneurs to register and manage their businesses.

The first steps for getting your business registered online will be on visiting the Our official Website SEVA BANDHU Registration portal.

Visit Our Website Web Online CA and Fill your basic details like your name ,mobile no and Email id .and verify your mobile number and processed next steps

In next step enter your personal Information like your official address, state, city, PAN Number, Zip Code, bank detail.

- MSME Udyam registration process is fully online, paper less, and based on self-declaration.

- No requirement of documents or proof for registering an MSME Udyam registration.

- Aadhaar Number will be enough for registration.

- PAN & GST linked details on investment and turnover of enterprises will be taken automatically from Government databases.

- PAN & GST number is mandatory from 01.04.2021.

FSSAI Registration (FSSAI License) is a legal requirement for food businesses in India. It is a mandatory process to get a 14-digit registration or license number from the Food Safety and Standards Authority of India (FSSAI). The FSSAI registration ensures that the food businesses comply with the food safety and hygiene standards prescribed by FSSAI. Moreover, it is also essential to obtain a food safety license from FSSAI before commencing the operations of the food business. Furthermore, the license or registration number should be compulsorily used by the food businesses on their food products and in advertising materials for selling food products. Thus, FSSAI registration is an integral part of the food business in India and is necessary for the safety and quality of food products.

What is fssai food license?

FSSAI Registration is a 14 digit registration number which is mandatory for all food-related businesses such as traders, manufacturers, import/export, and dairy farms. This registration number must be printed on all food products in order to obtain a license. It is essential for anyone involved in food processing, manufacturing, packaging, or distributing. Therefore, if you are in any of these fields, it is essential that you get an FSSAI Registration or Food License.

- Expert Advice and FSSAI eligibility consultation with Web Online CA.

- Application Drafting for FSSAI food Registration.

- FSSAI License 14-Digital number.

- All Product Category clarification.

- FSSAI Food Registration Renewal before the expiry.

- Legal documentation on a need basis.

- Basic Registration, State Registration, and Central Registration

Even after filing their Income Tax Return (ITR) on time, taxpayers may still receive a notice from the Income Tax Department (ITD). This is not always a cause for concern. In many cases, these notices are issued for routine clarifications, requests for additional information, or simply to provide updates.

Some notices require a timely response, while others are purely informational. Regardless of the nature of the notice, it's important that taxpayers first verify its authenticity before taking any action.

This guide will help you understand how to confirm whether an income tax notice is genuine and issued by the Income Tax Department.

The Income Tax Department considers your filed return as defective, meaning it has errors or missing information that makes it invalid for processing.

Issued under Section 139(9) of the Income Tax Act, 1961.

You must correct the defects and submit a revised return within 15 days from the date of receiving the notice.

If no action is taken within the allowed time, your return is treated as invalid, meaning it will be considered as not filed at all. This can lead to penalties.

Always check the ITR form type and completeness before filing. If unsure, consult a tax expert or CA to avoid receiving this notice.

Digital signatures are a means to authenticate the identity of signers and the integrity of signed electronic documents and messages. They are admissible as evidence in legal proceedings and provide a higher level of security than handwritten signature

A digital signature is a specific type of signature that is backed by a digital certificate, providing proof of your identity. Digital signatures are recognized as being a more secure type of e-signature because they're cryptographically bound to the signed document and can be verified.

When you use a digital certificate obtained from a trusted third party, the resulting digital signature is virtually impossible to spoof. It also provides powerful evidence of signer identity, that the signed document was not altered, and that the signatures are valid.

Industries use digital signature technology to streamline processes and improve document integrity. Industries that use digital signatures include the following:

- Government

Digital signatures are used by governments worldwide for a variety of reasons, including processing tax returns, verifying business-to-government (B2G) transactions, ratifying laws and managing contracts.

- Healthcare

Digital signatures are used in the healthcare industry to improve the efficiency of treatment and administrative processes, to strengthen data security, for e-prescribing and hospital admissions.

- Manufacturing

Manufacturing companies use digital signatures to speed up processes, including product design, quality assurance (QA), manufacturing enhancements, marketing and sales.

Governed by the labour departments of each state, the Shops and Establishments Act institutionalized the ambience and the state of the work environment and also established the privileges employees are allowed by their company or the management. This is best suited for shops all across India, every benefit-making foundation, lodgings, bistros, eating circles and joints, eateries, cinemas, and for all public places of entertainment. It is a must for every establishment and foundation to enlist oneself within 30 days of commencing under this act irrespective of the business being fully functional or not.

- Employee register and full details

-Payroll records - salary details, deduction, leave, overtime, fines, holidays, advance salaries

-Attendance

-All other details related to an employee

-All other allied registers.

Governed by the labour departments of each state, the Shops and Establishments Act institutionalized the ambience and the state of the work environment and also established the privileges employees are allowed by their company or the management. This is best suited for shops all across India, every benefit-making foundation, lodgings, bistros, eating circles and joints, eateries, cinemas, and for all public places of entertainment. It is a must for every establishment and foundation to enlist oneself within 30 days of commencing under this act irrespective of the business being fully functional or not.

Trademark registration is a vital process to protect the intellectual property rights of a business. By registering a trademark, owners ensure that their brand or logo is recognized and protected from infringement or misuse. Conjunctively, registering a trademark also provides an exclusive right to the owner to use the given mark, which helps to distinguish the product or service in the market. Additionally, trademark registration also allows for legal protection of the mark if another party attempts to use it. For these reasons, it is important for businesses to register their trademarks in order to secure and protect their intellectual property rights.

The applicant's name or signature should be included in any application, as it is a key identifier of the individual. The conjunctive adverb 'therefore' can be used to emphasize the importance of including the name or signature in any application, as it serves to verify the identity of the applicant. Therefore, it is essential to include the personal or surname of the applicant, as well as their signature, in all applications.

Google is a word that has been trademarked and is not directly descriptive of any character or quality of goods or services. This word has been registered as a trademark to protect its distinctive identity and reputation, thus allowing the company to distinguish its goods and services from those of competitors. The usage of a trademarked word is important to protect the brand and its associated value.

Alphanumeric, letters, numerals, or any combination thereof is widely used for various purposes, such as identifying brands, products, or services. Furthermore, this usage simplifies the process of tracking and managing data, thus making it easier for businesses to monitor their performance. All in all, alphanumeric, letters, or numerals are a convenient and effective way of labeling and tracking products and services.

Symbols, monograms, letters, 3-dimensional shapes, and other images such as the tick in the Nike logo are all used to create powerful visual statements. By combining these elements, a designer can create a memorable, striking design that communicates a powerful message

Sound marks in audio format, such as the sound in an ad jingle, are becoming increasingly popular. They are a unique way to differentiate a brand from its competitors, allowing for recognition and recall of the product or service.

Sound marks are an effective way to create an emotional connection with potential customers,

Trademark Registration showcases your unique identity

Trademark Registration helps you build trust and loyalty among your customers

Trademark Registration offers legal protection for your brand’s identity

Trademark Registration is an asset in itself

Trademark Registration prevents unauthorized usage of your brand’s identity.

Trademark registration classes are a system of classification used to categorize goods and services that are eligible for trademark protection. They are divided into 45 distinct categories, ranging from Class 1 (chemicals) to Class 45 (legal services). Conjunctive adverbially, each class is further subdivided into sub- classes that provide a more precise definition for what may be protected by a trademark. By properly registering a trademark in the appropriate class, businesses can ensure that their intellectual property is protected and that their brand is uniquely identified.

The popular Trademark registration classes in India are:

Class 9: includes computer software and electronics,

Class 25: includes clothing,

Class 35: includes business management and advertising, and

Class 41: includes education and entertainment.

Although the competition for a trademark may be greater when operating within certain trademark classes, it shouldn't be a deterrent, as long as the mark is unique.

The first and foremost requirement for start-up registration in India is to choose the right business structure. This choice will have a major impact on your business name, liabilities, tax filing, and other statutory dues. Furthermore, the success of the company will be largely determined by the business structure, making it essential to follow the online company registration in India process carefully.

Registering as a Private Limited Company (PLC) in India provides owners with the benefit of protecting their personal assets from any major losses or debts incurred by the business, unlike those in Partnership and Proprietorship firms; yet, simultaneously, they are limited to their capital contribution commitment. Consequently, this ensures that owners can safeguard their personal assets while still having a stake in the business.

A private limited company is a separate legal entity and continues in perpetual succession. Meaning that even if all the members die, or the company becomes insolvent or bankrupt, the company still exists in the eyes of the law.

The free and easy transferability of shares of a Private Limited Company makes it convenient for shareholders to buy and sell their shares. This helps to ensure that the ownership and control of the company is maintained and also facilitates business transactions. Furthermore, it also allows the owners to diversify their portfolios by buying and selling their shares in a timely manner. In addition, it ensures that the company is run in accordance with the law and the rights of the shareholders are not abused.

A company, being a juristic person, has the ability to acquire, own, enjoy, and alienate property in its own name. Furthermore, no shareholder can make any claim on the property of the company, so long as it is a going concern. Therefore, it is important to note that shareholders are not the owners of the company's property, as the company itself is the true owner.

A Private Limited Company offers tax efficiency, as it can benefit from various tax deductions and exemptions. The use of a conjunct adverb such as 'therefore' can be used to emphasize this point, as a Private Limited Company is therefore an ideal option for businesses looking to maximize their tax efficiency. The company structure of a Private Limited Company provides an array of advantages such as limited liability, limited exposure to creditors, and enhanced credibility, all of which can contribute to a more tax-efficient business structure. Additionally, a Private Limited Company may be eligible for certain tax exemptions and deductions, such as capital gains tax relief and corporation tax relief, which can further help with reducing the overall tax burden of a business. In conclusion, a Private Limited Company is an attractive option for businesses looking to maximize their tax efficiency, and therefore should be strongly considered.

Flexible Management Structure Private Limited Company (FMSPL) is a company that offers a unique and innovative business model, allowing it to provide a wide range of services to its clients. It has a highly flexible management structure which is tailored to the specific needs and requirements of each client, enabling it to deliver a customized and efficient service. Furthermore, FMSPL also offers a range of risk management solutions, allowing it to protect its clients from any unforeseen financial risks. Overall, FMSPL provides a comprehensive, efficient and cost-effective service, giving its clients peace of mind and assurance.

To form a company, you need to fill out a simple company registration form and submit the required documents. Furthermore, additionally, you must provide documents to the registrar to complete the registration process.

After submitting your documents, we will promptly provide you with both a Digital Signature Certificate (DSC) and a Director/Partner Identification Number (DPIN) for your convenience.

In order to apply for name approval, the details provided by you will be verified first and then, accordingly, the application will be made.

We will not only create all the necessary documents, but also file them with the Registrar of Companies (ROC) on your behalf. Thus, we can ensure that your paperwork is in order and filed in a timely manner.

Once your company is incorporated, we will promptly send you all the necessary documents and Digital Signature Certificates (DSCs).

Once your company is incorporated, we will promptly send you all the necessary documents and Digital Signature Certificates (DSCs).

Registering for a Business Registration Number (BRN) or Sanstha Aadhaar Number (SAN) in Rajasthan offers many benefits to businesses and non-profit organizations. Here are the list of some important benefits

Taxation Benefits

BRN and SAN registration is often a prerequisite for obtaining a tax identification number such as the Goods and Services Tax Identification Number (GSTIN) or the Employer Identification Number (EIN). It helps your business to meet its tax responsibilities and facilitates tax reporting and compliance.

Provides banking and finance facilities

Banks and financial institutions may require BRN or SAN registration documents when opening business accounts, applying for loans, or seeking other financial services. BRN / SAN registration streamlines banking processes and manages financial transactions for your business.

Legal Recognition

Obtaining a BRN or SAN provides legal recognition to your business or non-profit organization, establishing its validity in the eyes of the law and enabling it to operate within the regulatory framework.

Government Contracts and Tenders

Registered entities are often given preference when bidding for government contracts and tenders. BRN or SAN registration increases eligibility to participate in government procurement opportunities, expanding business or organizational prospects.

Generate digitally signed GST compliant e-invoices with QR code easily.

Keep track of all your receivables & payables at all times on Dashboard. Get clear visibility of money.

Manage your stock, purchases and sales easily. Categorize Items, maintain , get low stock alerts and daily report.

e-Way Bill cannot be generated with only SAC codes(99) for Services, minimum one HSN code.

Web Online CA automatically backups your data from your Device & syncs it to other devices.

Track employee attendance, preventing time theft, and improving security.